Summary

- S.E.C.'s decision to charge the crypto exchange Kraken with securities violations regarding its staking services. Funds were not directly staked to the dedicated Blockchain but instead managed by Kraken pool to avoid unstaking period. SEC considers the staking service close to lending activities. To settle the charges, Kraken is paying $30 million and shutting all of its U.S. staking services.

- Circle alerted the New York regulator to Binance's historical undercollateralization of Binance-peg tokens BUSD last autumn, Binance delisted USDC for its platform, converting automatically to BUSD. Issues reported in January led to action against Paxos the BUSD stablecoin issuer, ordered to halt creation for BUSD after received a Wells notice from the SEC on February 3, 2023.

- Wormhole exploiter (one of the biggest hack 93,750 ETH) has moved $61 million to lending services MakerDAO and liquid staking (Lido).

- TradFi on DeFi. A Swiss company is offering a token tied to a BlackRock ETF that tracks hundreds of big American tech stocks.

- Central Bank of the United Arab Emirates (CBUAE) plan to launch a central bank digital currency (CBDC) for cross-border and domestic use as part of the first of its newly-launched financial infrastructure transformation (FIT) program.

- First collection of modern art in Europe at Centre Pompidou will open this spring. A NFT exhibition targeting the intersection of art and blockchain, the first of his kind.

- Hermès Wins Trademark Lawsuit Against MetaBirkins NFTs, Setting Powerful Precedent for NFT Creators. Jurors Not Convinced NFTs Are Art.

To watch this week

- Consumer Price Index (CPI) - Tuesday the 14th - 2:30 CET

Business

BlackRock ETF? There’s a Token For That - Decrypt

Backed Finance offers a token tied to a BlackRock ETF that tracks hundreds of big American tech stocks. But you can’t get the token in the US.

Bankrupt Genesis Unveils Plan to Pay Back Creditors - Decrypt

Digital Currency Group plans to sell both Genesis Global Holdco and Genesis Global Trading to pay back creditors.

LocalBitcoins to Shut Down After 10 Years of Operation - Decrypt

Citing the “ongoing very cold crypto-winter,” the P2P exchange LocalBitcoins announced it will discontinue services beginning today.

Network Activity on Ethereum Is Up, With Uniswap Leading the Charge

Ethereum is entering its fourth consecutive week of deflationary issuance as activity on the network grows.

#PeckShieldAlert The Wormhole Network Exploiter 0x629e supplied $46M worth of cryptos, including 24.4k $wstETH ($41.4M) & 3k $rETH (~$5M), to MakerDAO for 16.6M $DAI & used them to buy 9.75k $ETH ($ETH at $1,537) & 1k $stETH ($ETH at $1,543), then wrapped them for ~9.7k $wstETH pic.twitter.com/BRfygHgpit

— PeckShieldAlert (@PeckShieldAlert) February 12, 2023

France’s top modern art museum to display CryptoPunks, Autoglyphs NFTs

The Centre Pompidou announced plans for a permanent exhibition focusing on NFTs.

Markets

Crypto Charts 99

Bitcoin Last time we said: Whilst below $24′255, the wave (i) high, we are looking for lower in 3 waves. This will provide us the opportunity to buy. Retracement buy levels come in at $22′160, $20′880 and $19′850. Add to longs at these levels with stops remaining at $16′400 The

- $186 million in long liquidations on February 9th, highest volume of lung liquidations over the past 90 days after market reaction due to SEC announcement about Kraken fine.

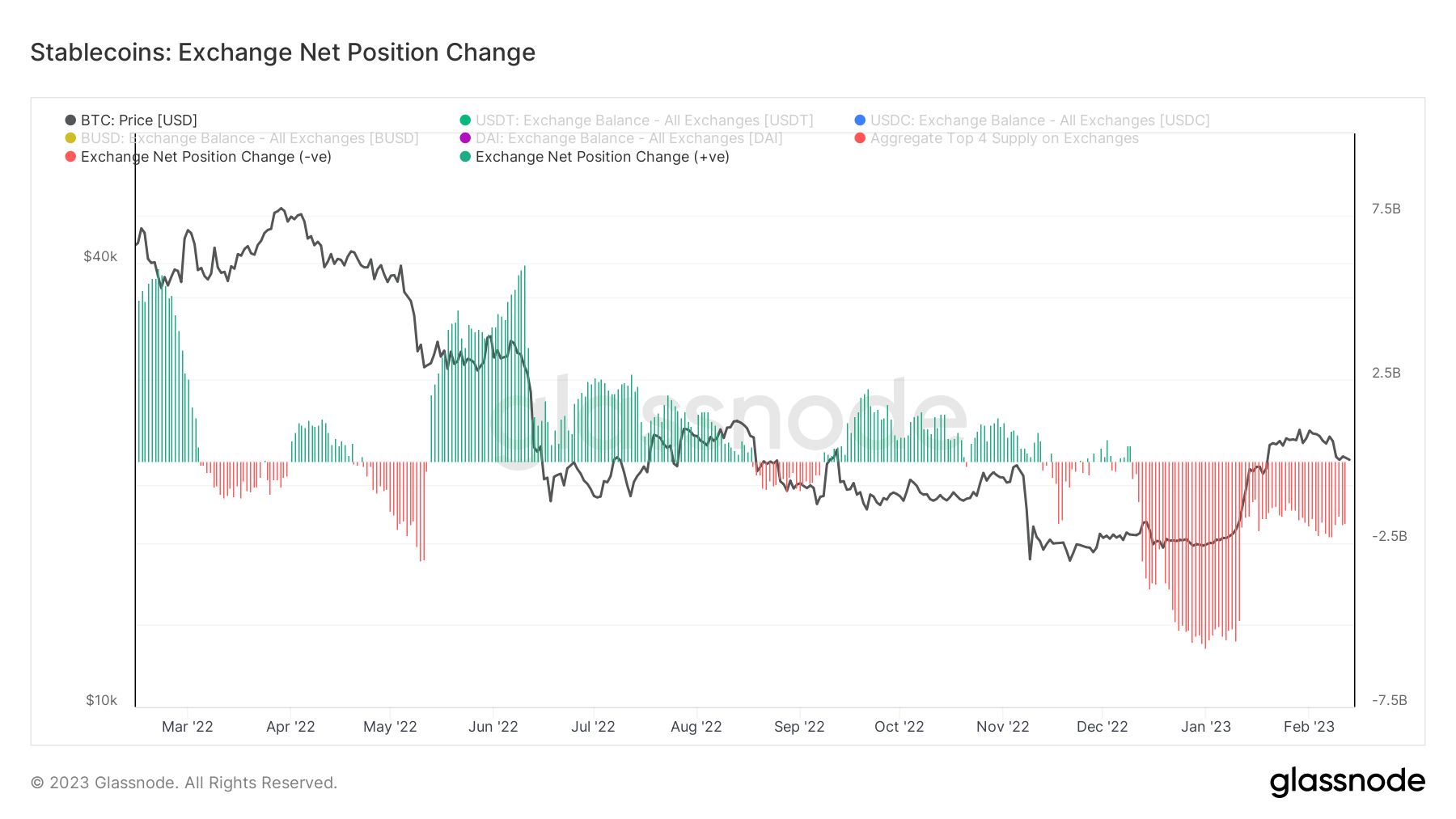

- Stablecoins continue to leave exchanges implying that January retake was probably a bull trap. Negative balance of $1.8 billion today.

Regulations

Binance Stablecoin Is a Security, SEC Tells Paxos: WSJ

Binance USD issuer Paxos has reportedly been hit with a Wells notice, meaning the SEC intends to sue unless it can be convinced otherwise

SEC Hits Kraken With $30 Million Fine, Orders Crypto Exchange to Halt Staking in US - Decrypt

Kraken has agreed to pay the SEC $30 million and halt its staking service for U.S. clients, the SEC announced today.

Breaking: Paxos reportedly ordered to stop issuing Binance USD

Regulators ordered New York-based blockchain company Paxos Trust to stop issuing Binance USD after a lawsuit threat by the SEC.

UAE central bank to issue CBDC as part of its financial transformation program

The government is also planning to launch a unified and instant card payment platform.

Opinions

Blockchain Privacy Is at Risk in the EU

The EU’s comprehensive Markets in Crypto Assets (MiCA) regulation is ambitious and sets a high standard globally. Article 68, however, goes too far and poses a risk to innovation, privacy and security.

Podcast / Reading

SLP458 AI and the Economy with Peter St Onge

Peter St Onge rejoins me on the show to talk about AI and what it means from an economic perspective. Many believe that all the jobs will disappear or there will be massive economic chaos. We…

What Is Tokenomics? The Investor’s Guide

Discover the ins and outs of tokenomics with this comprehensive investor’s guide. Learn what it is, and how to identify red flags when analyzing crypto assets.