Weekly Price Action

- Prices opened the week at $43.1k and traded tightly within the $41k-$43k range

- Prices reached a weekly high of $43.4k on January 20th

- This high was followed by a 25% drop to $33.4k, a low last seen in August 2021

- Price swiftly recovered and is currently trading at $36.2k

Bitcoin in 2022

Bitcoin's price has continued to decline in 2022. This drop has been impacted by several macro news headlines that have contributed to the negative sentiment felt in the Bitcoin and crypto market in recent weeks.

Below is a graph of the major events that have had an impact on Bitcoin's price:

Bitcoin Hourly Chart - January 2022

Hawkish Fed causes sell-off in Bitcoin

The Federal Reserve released its FOMC meeting notes on January 5th. They expressed a newly hawkish stance which lead to a sell-off in the Bitcoin and Crypto markets. The sell-off occurred as the market was already pricing in the expected interest rate hikes and quantatative tightening later on in the year.

The Crypto-Currency market has benefitted from the easy and loose monetary policy implemented by the Federal Reserve since March 2020. That is why the tightening of monetary policy is perceived as a negative for Bitcoin. Furthermore, the Crypto asset class is currently considered as a more of a risk-off investment by investors given its correlation to Tech and Growth stocks in recent months.

High Inflation Numbers causes Spike in Bitcoin Price

Although the rate of infation declined from 0.8% in November to 0.5% in December, annual inflation was 7% for 2021, the highest annualized increase since 1982.

This had a noticeable effect on Bitcoin's price, as BTC trading volume surged and prices spiked after the release of the CPI numbers. A signficant number of traders bought Bitcoin as they deemed it as a functional hedge to high inflation.

It is important to note however, that Bitcoin's role as a hedge to inflation remains theoretical, as the asset has been trading like a speculative risk asset in the last 6 months. This can be evidenced by the correlation between the crypto and equity markets during the same time frame.

Potential Crypto Ban in Russia triggers Liquidation Cascade

Russia's central bank released a report on the 20th of January stating that Russia needs to ban all crypto-related activities whilst Bitcoin was trading around $42k.

The suggested ban entailed shutting down all mining activity in Russia, the third largest mining hub in the world. The announcement added more uncertainty to the already declining Bitcoin market.

Most analysts as well as our in-house chart analyses had asserted $39.6k as a key support level, as it was the multi-month low established in September. As such, many traders bought call options above this support level with leverage.

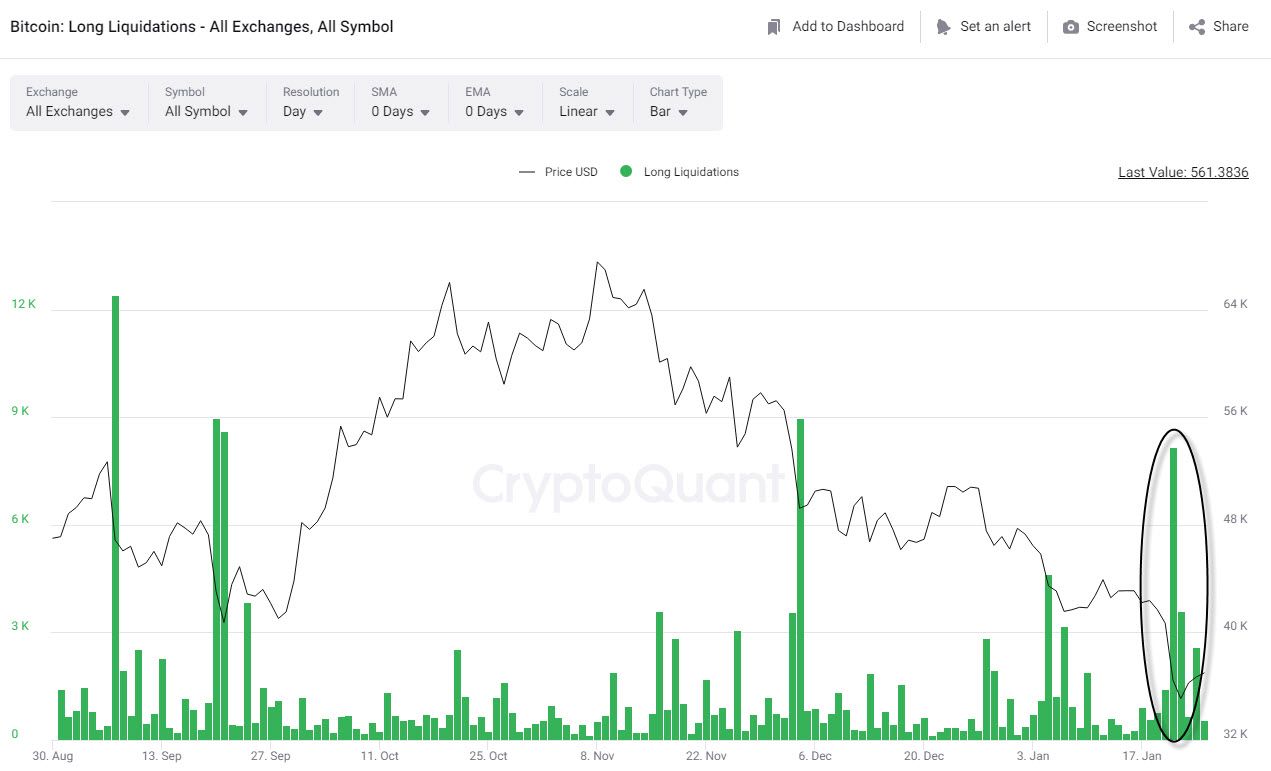

The news from Russia combined with the Fed's hawkish stance applied enough pressure to push prices below the expected support level and trigger the liquidation of long positions.

Derivatives traders have to fund their positions if the market moves against them. If a trader has insufficient funds, the contract is liquidated, which adds pressure to the direction the market is going in.

On Januray 21st, $600 million worth of contracts were liquidated in the crypto market, with $250 million worth of contracts, mostly longs, liquidated in the Bitcoin market.

The graph below illustrates this spike in liquidations which contributed to the sudden drop in prices.

Concluding Remarks

-

There has been negative sentiment in the Bitcoin and Crypto markets so far in 2022, mainly due to the Fed's hawkish stance

-

Macro headlines are primarily driving price action in the short term in the Bitcoin market

-

Open interest in the Crypto market is high which is creating the risk of significant liquidations and high volatility in prices