We provide liquidity for the major DeFi tokens that are currently shaping the Digital Asset space. Execution and custody is handled in-house.

Below is a complete list of our DeFi Token Offering:

Chainlink

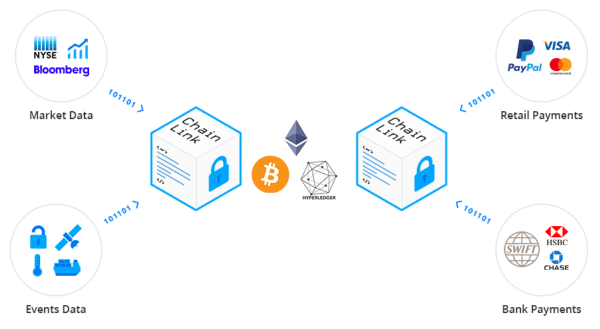

Launched in 2017, Chainlink built an open source protocol on Ethereum that provides real-world data (off-chains) to smart contracts (on-chain) on the blockchain.

Because smart contracts can’t communicate with external sources like financial feeds or data across all kind of assets, Chainlink has developed a decentralised

oracle network technology, a node layer acting as an interface for smart contracts and off-chain resources.

Smart contracts on any blockchain can leverage extensive off-chain resources

and events, such as tamper-proof price data, verifiable randomness, external

APIs connectivity operating with existing software and much more.

Chainlink is the most used Oracle service representing 80% of the actual oracle

market activity.

Token Details

Type : ERC-20 Ethereum Token

Max Total Supply: 1,000,000,000 LINK

Wallets holding:

Active wallets:

Trading Volume 24h :

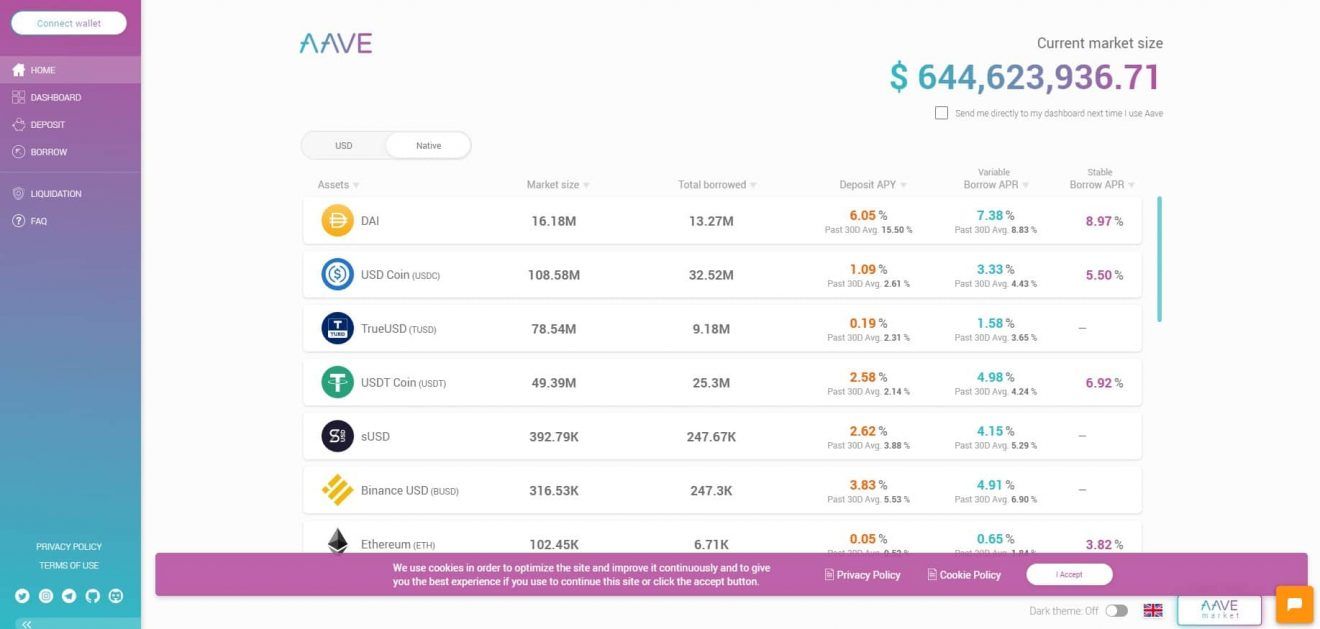

Aave

Aave is an Open Source and Non-Custodial protocol to earn interest on deposits and borrow digital assets.

Loans require collateral (such as ETH) provided by the borrower. Each asset in the Aave protocol has specific values related to their risk, which influences how they are loaned and borrowed.

To facilitate this activity, Aave issues two types of tokens: aTokens, issued to lenders so they can collect interest on deposits, and AAVE tokens, which are the native token of Aave.

Aave allows certain loans, called “flash loans,” to be instantly issued and settled. These loans require no upfront collateral and happen almost instantly.

Flash loans take advantage of a feature of all blockchains, which is that transactions are only finalized when a new bundle of transactions, known as a block, is accepted by the network. AAVE borrowers don’t get charged a fee if they take out loans denominated in the token. Also, borrowers who use AAVE as collateral get a discount on fees.

In July 2020, AAVE is launching a permissioned version of its platform for institutional investors.

Token Details

Type : ERC-20 Ethereum Token

Max Total Supply: 10,000,000 Aave

Total Value Locked: $8,85 billion

Wallets holding:

Active wallets:

Trading Volume 24h:

Compound

Compound started in September 2018, an algorithmic money market protocol on Ethereum that lets users earn interest or borrow digital assets against collateral.

Users can supply assets to Compound’s liquidity pool and immediately begin earning continuously-compounding interest. Rates adjust automatically based on supply and demand. Users can add or remove funds at any time, but if their debt becomes undercollateralized, user can liquidate; a 5% discount on liquidated assets serves as incentive for liquidators.

The Compound protocol sets aside 10% of interest paid as reserves; the rest goes to suppliers.

In May 2020, Compound has transitioned to community governance; COMP token-holders

and their delegates debate, propose, and vote on all changes to Compound.

In July 2021, Compound launched Treasury Accounts to convert USD to USDC, a digital dollar stablecoin, and supplies them to the Compound Protocol to generate secure, high-yield interest.

This enables institutions to access crypto interest rates without the need of digital assets infrastructure.

Token Details

Type : ERC-20 Ethereum Token

Max Total Supply: 10,000,000 COMP

Total Value Locked in Compound protocol : $8.85 billion

Wallets holding:

Active wallets:

Trading Volume 24h:

UNISWAP

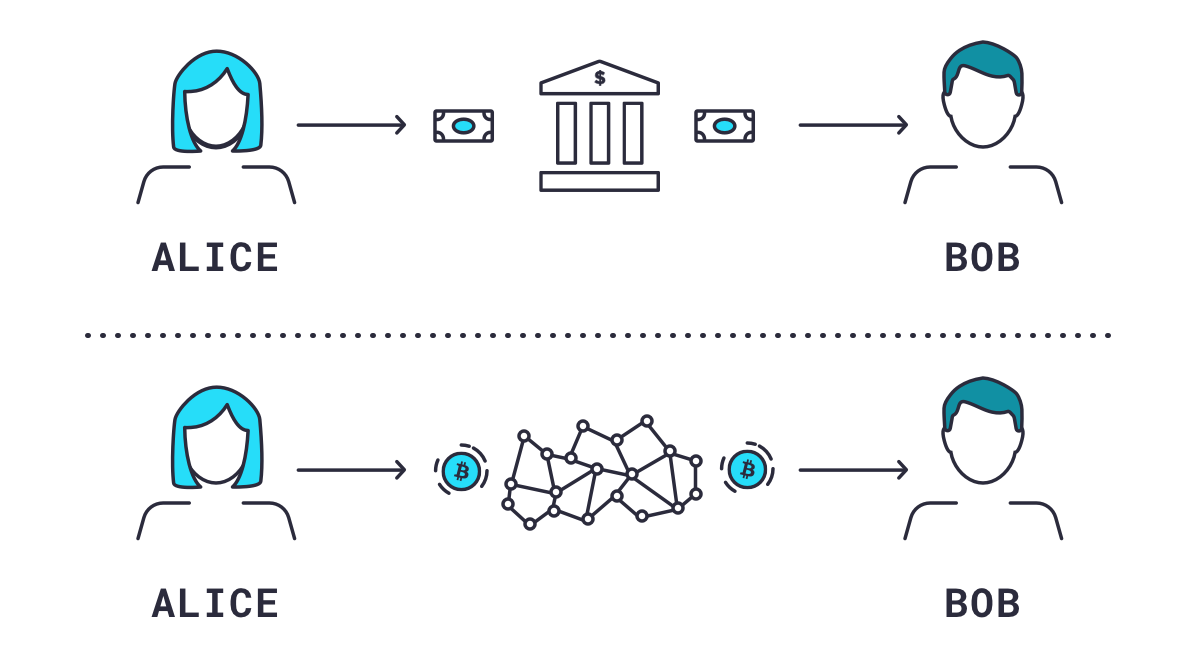

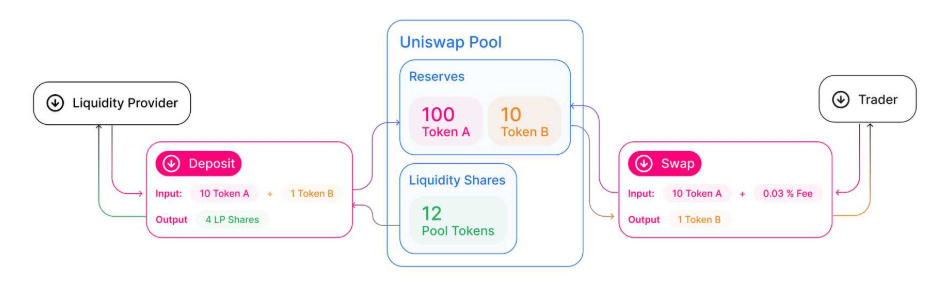

Created in 2018, Uniswap is an Ethereum-based decentralized exchange (DEX), a service to trade tokens without proprietary platform or middlemen.

The protocol facilitates automated transactions between cryptocurrency tokens on the Ethereum blockchain through the use of smart contracts.

With a DEX, traders do not have to deposit their tokens on an exchange and be exposed to the security risks of a centralized exchange

Anyone can quickly swap between ETH and any ERC20 token or earn fees by supplying any amount of liquidity, anyone can create a market (i.e., liquidity pool) by supplying an equal value of ETH and an ERC20.

Uniswap popularized the Automated Market Maker (AMM) model which uses a pricing algorithm to price assets. AMM allow digital assets to be traded without permission and automatically by using liquidity pools instead of a traditional market of buyers and sellers.

In February 2021, it became the first DEX to process more than $100 billion in trading volume, UNI is a governance token, so owners can participate in decisions on how the platform is run. Uniswap’s almost exclusive source of revenue is fees for orders

Token Details

Type : ERC-20 Ethereum Token

Max Total Supply: 1,000,000,000 UNI

Total Value Locked: $6.16 billion

Wallets holding:

Active wallets:

Trading Volume 24h :

yearn.finance

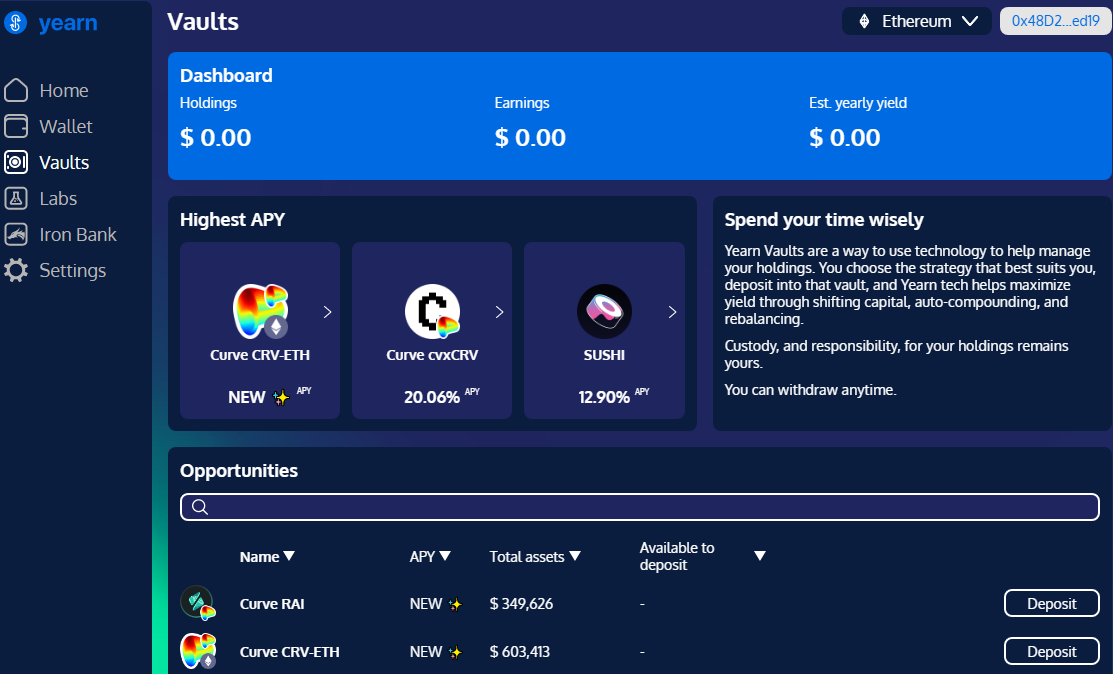

yearn.finance is a group of protocols running on the Ethereum blockchain that allow users to optimize their earnings on crypto assets through lending and trading services. Yearn Finance acts as an aggregator for decentralized finance (DeFi) protocols such as Curve, Compound, and Aave to simplifying DeFi investment and activities such as yield farming. To do this, it has built a system of automated incentives around its YFI cryptocurrency.

As one of the first emerging DeFi projects, yearn.finance provides its services completely autonomously, using only code and so removing the need for a financial intermediary. The protocol charges 2% management fees and 20% performance fee, 0.5% for withdrawals and 5% for its Vaults service.

YFI token benefits directly from the protocol’s earnings. The management fees and 50% of the performance fees accrues to the treasury that is controlled by the YFI token holders.

Protocol earnings are used to buy back YFI from the open market and with a limited number of YFI, its price may be driven by its scarcity and the protocol use which exercice pressure on the buying side.

Token Details

Type : ERC-20 Ethereum Token

Max Total Supply: 36,666 YFI

Total Value Locked: $3.38 billion

Wallets holding:

Active wallets:

Trading Volume 24h:

Curve

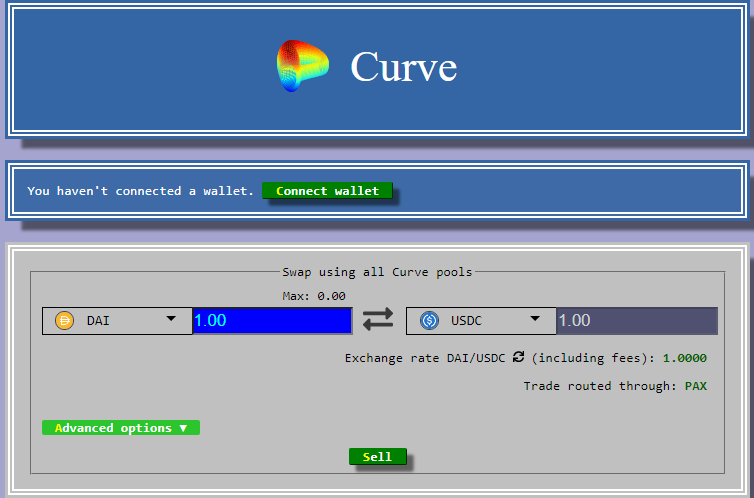

Launched in August 2020, Curve Finance is a Decentralized Exchange optimized designed for extremely efficient stablecoin trading. The protocol employs an Automated Market Maker (AMM) that was built specifically to give traders low slippage and liquidity providers steady fee revenue.

Behind the scenes, the tokens held by liquidity pools are also supplied to the Compound protocol or Yearn.finance where to generate more income for liquidity providers.

It implemented a complex time-based staking system to exchange CRV into veCRV an internal token intended for governance purpose and has a right to claim the cash flows generated by the protocol, even introduce token burning schedules for CRV.

The Curve wars is an interesting development within the DeFi space. More information can be found here

Token Details

Type: ERC-20 Ethereum Token

Max Total Supply: 3.03 billion CRV

Total Value Locked: $9.1 billion

Wallets holding:

Active wallets:

Trading Volume 24h:

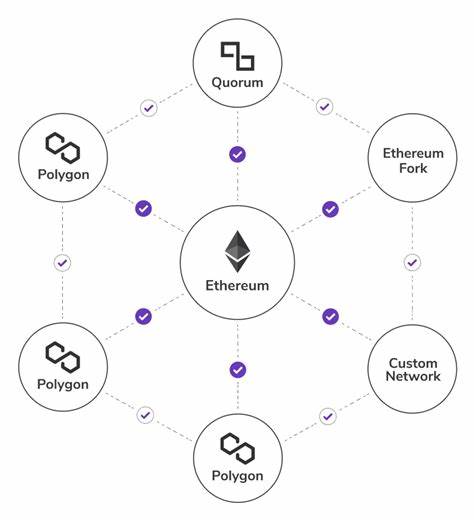

Polygon

Originally was called Matic Network in 2017, it has been rebranded into Polygon in February 2021. Polygon is designed to be an entire platform designed for launching interoperable blockchains starting a layer-2 network for building interoperable, Ethereum-viable blockchain networks. Meaning it acts as an add-on layer to Ethereum that does not seek to change the original blockchain layer.

It try to solve known issues associated with Ethereum, like high transaction fees and slow speeds, without sacrificing on security. The team extended the features to internet of blockchain, building interoperability between Blockchain and is

akin to other ones such as Polkadot, Cosmos, Avalanche.

The Polygon system comprises numerous members, including block creators, developers, clients, and stakeholders. Polygon clients utilize the MATIC Sidechain to execute and cooperate with different Ethereumbased decentralized apps.

It is to be noted that MATIC is a lot less expensive and quicker than other networks. Using Polygon, one can create Optimistic Rollup chains, ZK Rollup chains, stand alone chains or any other kind of infra required by the developer.

Matic is allocating 12% of its total supply of 10 billion tokens towards staking rewards. These 1.2 billion tokens will be the staking incentive for the first five years. The incentive is gradually reduced every 30 minutes. The $MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance.

Token Details

Type: ERC-20 Ethereum Token

Max Total Supply: 10,000,000,000 Polygon (MATIC)

Total Value Locked: $4,52 billion

Wallets holding:

Active wallets:

Trading Volume 24h:

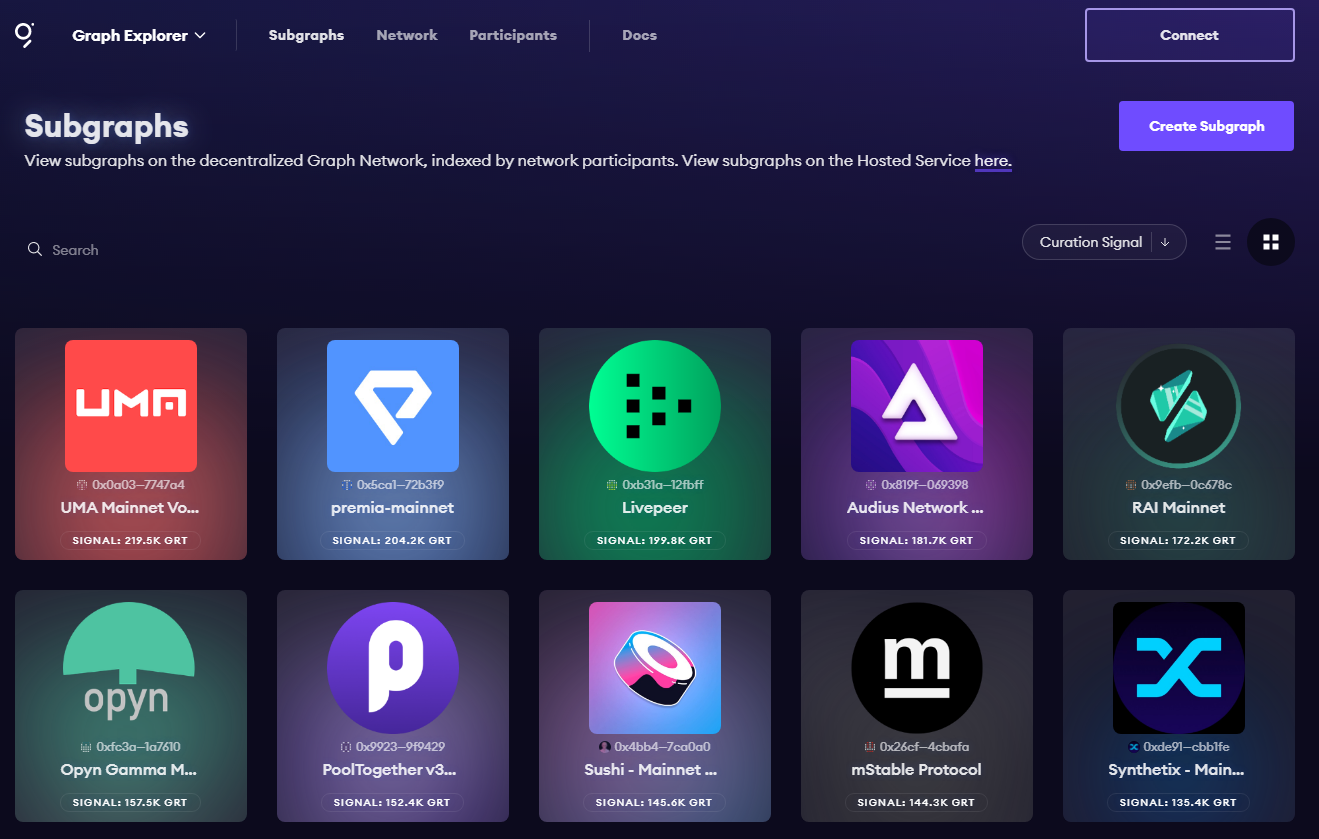

The Graph

The Graph is an open-sourced software used to collect, process and store data from

various blockchain applications to facilitate information retrieval. Originally launched on the Ethereum blockchain, The Graph’s mission is to help developers use relevant data to increase the efficiency of their decentralized application (dapp).

The Graph analyzes and gathers blockchain data before storing it into various indices, called Subgraphs, allowing any application to send a query to its protocol and receive an immediate response.

The Graph’s native cryptocurrency, GRT, is used to ensure the integrity of the data secured within its network. Any user, whether they are indexers, curators or delegators, must stake GRT to perform their roles, and, in return, earn fees from the network.

The Graph is being used by popular Ethereum dapps like Aave, Curve and Uniswap.

The Graph raised a total of $19.5 million in token sales since 2019 has been sold to investors including Coinbase Ventures, Digital Currency Group and Multicoin Capital.

The GRT cryptocurrency derives its value from its ability to ensure the successful execution of smart contracts that depend on the The Graph protocol. Most notably, GRT is the only cryptocurrency used for key network operations. For example, consumers who submit queries to indexers must pay a query fee, denominated in GRT.

Token Details

Type: ERC-20 Ethereum Token

Max Total Supply: 10,000,000,000 GRT

Total Value Locked: $2.34 billion

Wallets holding:

Active wallets:

Trading Volume 24h:

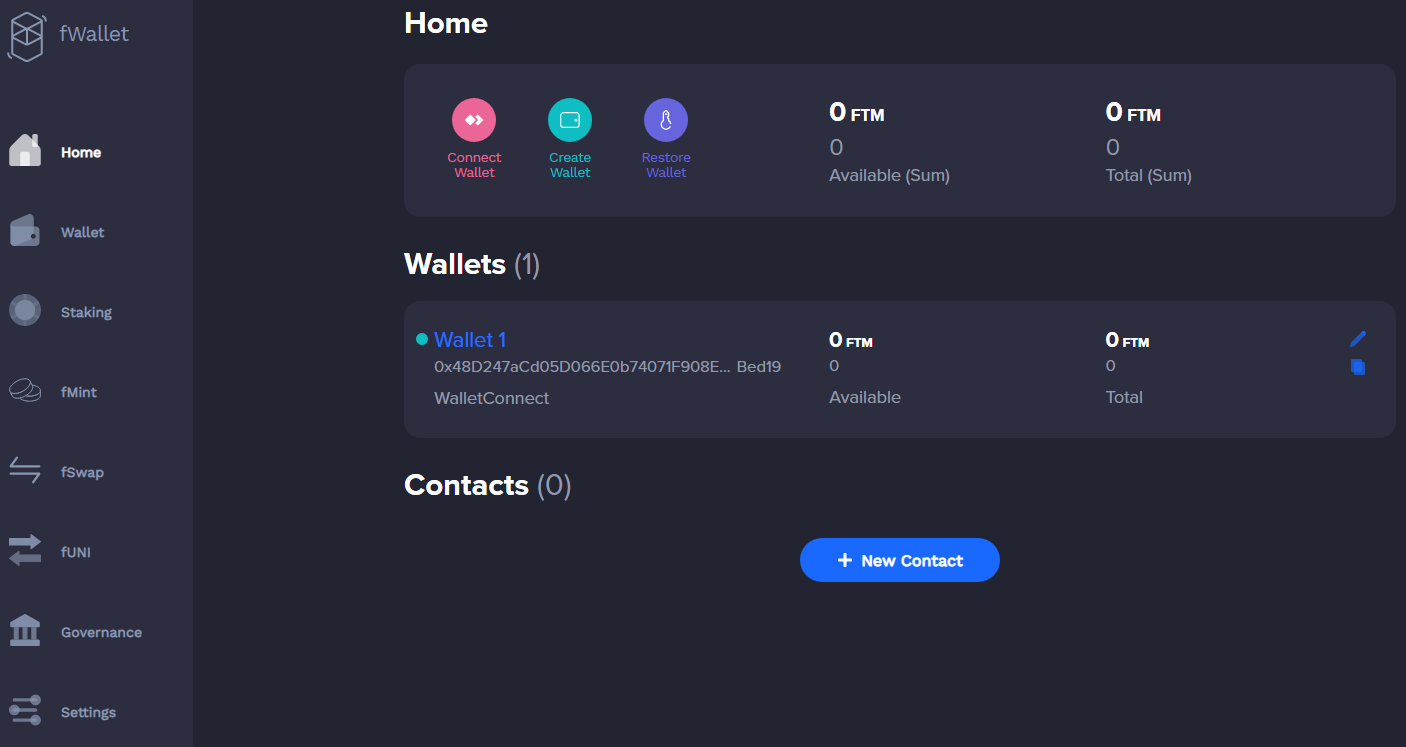

Fantom

Created in 2018, Fantom is a high-performance, scalable, customizable, and secure smart contract platform. The platform is designed as a next generation of blockchain to address several limitations of existing blockchain platforms. Fantom is permissionless, decentralized, and open-source.

Fantom is a Proof of Stake Blockchain and Lachesis, its aBFT consensus protocol, has made Fantom Blockchain much faster and cheaper than previous technologies, yet extremely secure. Fantom has improved scalability and the transaction speeds can rise to more than 300k per

second

It’s fully compatible with Ethereum Virtual Machine, meaning that all services running on Ethereum can easily migrate on Fantom at the fraction of their current operational costs. There is now a free to bridge from Ethereum to Fantom enabling assets moving from a chain to another chain at the cost of the transaction fee.

The foundation has unveiled a 380 FTM token grant fund to boost ecosystem development and attract existing and new DeFi protocols as well as NFT platforms. Fantom is cooperating with commercial and central banks and governments in South Africa, Middle East and Europe

Token Details

Type: ERC-20 Ethereum Token / FTM Opera Blockchain / BEP2

Max Total Supply: 3,175,000,00 FTM

Total Value Locked: $ 1.23 billion

Wallets holding:

Active wallets:

Trading Volume 24h: